In

Permanent Life Insurance: How It Works & Why You Need It

“Contextual Prelude”

“Life insurance serves as a vital financial safeguard, ensuring your loved ones are protected and financially supported in your absence. Among the different types, permanent life insurance stands out because it offers lifelong coverage along with a savings component. Unlike term insurance, which expires after a set period, permanent life insurance remains active as long as premiums are paid.

In this guide, we’ll break down how permanent life insurance works, its benefits, the application process, required documents, eligibility criteria, and more.

Permanent Life Insurance: What You Need to Know

Permanent life insurance is a long-term financial protection plan that remains in effect for the insured’s entire lifetime, For the duration that premiums continue to be paid. Unlike term life insurance, which covers a specific period, permanent life insurance offers lifelong coverage and typically includes . It also includes a cash value portion that increases gradually over time, acting as a savings or investment feature.

Core Aspects of Permanent Life Insurance

Lifetime Protection – Coverage remains in effect for your entire life, provided premiums are consistently paid.

Growth of Policy’s Cash Component A portion of your premium contributes to a tax-deferred savings component that accumulates over time.

Level Premiums – Enjoy predictable costs, as premiums generally stay fixed for the duration of the policy.

- Death benefit – Tax-free payout to beneficiaries upon the policyholder’s death.

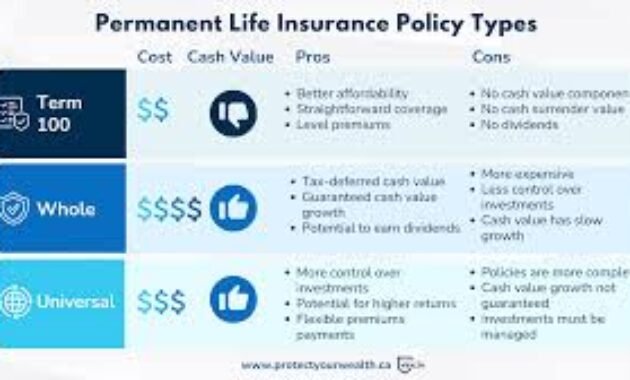

Permanent Life Insurance Policy Types

Whole Life Insurance – Provides lifelong coverage with consistent premium payments and a guaranteed accumulation of cash value over time.

- Universal Life Insurance – Flexible premiums and adjustable death benefits.

- Variable life insurance invests its cash value in stocks and bonds, providing the potential for greater growth, but and is associated with greater risk levels.

- Indexed Universal Life Insurance – Cash value growth is linked to a market index (e.g., S&P 500).

Exploring the Structure and Benefits of Permanent Life Insurance”

Permanent life insurance functions in two main ways:

1. Death Benefit Protection

- When the policyholder passes away, the insurer pays a tax-free lump sum to the beneficiaries.

- The amount remains fixed (in whole life) or can be adjusted (in universal life).

2. Cash Value Growth

- A part of every premium you pay is allocated to a cash value account, which gradually builds over time.

- This amount grows tax-deferred over time.

- Policyholders can borrow against or withdraw from the cash value (subject to terms).

Application Process for Permanent Life Insurance

Getting permanent life insurance involves a few key steps:

Step 1: Research & Compare Policies

- Assess different insurers, policy types, and premium costs.

- Consider leveraging reputable online resources or seeking guidance from a qualified insurance advisor.

Step 2: Get a Quote

- Provide basic details (age, health, coverage amount) for a premium estimate.

Step 3: Undergo Medical Examination (If Required)

- Some insurers require a medical exam to assess risk.

- Non-medical policies may skip this but have higher premiums.

Step 4: Submit Application & Documents

- Fill out the application form with personal and financial details.

- Submit necessary documents (listed below).

Step 5: Policy Approval & Activation

- The submitted application undergoes a detailed examination by the insurance company.

- Once approved, sign the agreement and pay the first premium to activate coverage.

Documents Required for Permanent Life Insurance

To apply, you’ll typically need:

- Proof of identity (Aadhaar, PAN, passport, or driver’s license)

- Certainly! Here’s a more professional and unique rewording of your sentence:

- “Proof of residential address, such as utility bills, lease agreements, or similar official documents.”

- Would you like additional variations or a more formal/legal version?

- Income proof (salary slips, IT returns, or bank statements)

- Medical records (if applicable)

- Nominee details (name, relationship, contact info)

Eligibility Criteria for Permanent Life Insurance

While criteria vary by insurer, common requirements include:

Age Eligibility – Typically ranges from 18 to 65 years, though some insurers may provide coverage up to age 80.

Medical History – Existing health conditions can influence both eligibility and premium rates.

Reliable Economic Foundation Demonstrating a consistent income stream is essential to support regular premium payments.

Smoking status – Smokers may pay higher premiums.

Benefits of Permanent Life Insurance

✅ Lifetime coverage – No risk of policy expiration.

✅ Cash value growth – Acts as a savings/investment tool.

✅ Favorable tax treatment – – Death benefit is tax-free; cash value grows tax-deferred.

✅ Loan option – Borrow against cash value in emergencies.

Asset Management for Inheritance – Helps in wealth transfer to heirs.

- Individuals seeking lifelong protection.

- High-net-worth individuals for estate planning.

- Parents wanting to leave an inheritance for children.

- Those who want savings alongside insurance.

Final Thoughts

Permanent life insurance is a powerful financial tool that combines lifelong protection with wealth-building benefits. While premiums are higher than term insurance, the long-term advantages—like cash value growth and guaranteed death benefits—make it a smart choice for many.

Before choosing a policy, compare different plans, assess your financial goals, and consult an expert if needed. The right permanent life insurance policy can provide financial security for your family and peace of mind for you.

Have questions about permanent life insurance?