Akhuwat Student Loan 2025 – A Complete Guide to Interest-Free Education Financing in Pakistan

Introduction

In a country where millions of students struggle to afford higher education, the Akhuwat Student Loan 2025 emerges as a beacon of hope. Unlike traditional bank loans with high-interest rates, Akhuwat Foundation offers interest-free financial assistance to deserving students, ensuring that so that no gifted individual is held back by financial limitations.

Founded on the principles of Qarz-e-Hasna (a benevolent loan in Islam), Akhuwat has already transformed thousands of by offering affordable and inclusive education funding options. If you’re a student in Pakistan looking for a Sharia-compliant, no-interest loan to fund your studies, this comprehensive guide will walk you through eligibility, application steps, required documents, repayment terms, and key benefits of the Akhuwat Student Loan 2025.

What is the Akhuwat Student Loan Program?

Akhuwat Foundation, Pakistan’s largest interest-free microfinance organization, launched its student loan program to eliminate financial barriers in education. The initiative supports students enrolled in universities, colleges, and technical institutes across Pakistan, covering tuition fees, books, and other academic expenses.

Why is Akhuwat Loan Different from Bank Loans?

✔ Zero Interest – Unlike conventional loans, Akhuwat follows Islamic financing principles.

✔ No Collateral Required – Students don’t need property or guarantors.

✔ Flexible Repayment – Payments start only after graduation.

✔ Social Responsibility – Encourages beneficiaries to give back to society.

Who Can Benefit from Akhuwat Student Loan 2025?

- Undergraduate & Postgraduate Students (Medical, Engineering, Arts, etc.)

- Technical & Vocational Training Students

- Students from Low-Income Families

- Orphans & Special Needs Students

Eligibility Criteria for Akhuwat Student Loan 2025

To ensure financial aid reaches the most deserving candidates, Akhuwat has set specific eligibility requirements.

1. Academic Requirements

- Must be enrolled in a recognized Pakistani university/college.

- Minimum 50% marks in previous exams (varies by institution).

- Admission confirmation letter from the educational institute.

2. Financial Eligibility

- Family income should be below the poverty threshold (varies by region).

- Priority is given to:

- Orphans

- Students from underprivileged backgrounds

- Families with multiple dependents

3. Additional Conditions

- Pakistani nationality (CNIC/B-Form required).

- No concurrent scholarships or loans (dual financial aid is not allowed).

- Commitment to repay after securing employment post-graduation.

Step-by-Step Application Process for Akhuwat Loan 2025

Applying for the Akhuwat Student Loan is straightforward but requires careful documentation. Here’s a detailed breakdown:

Step 1: Check Application Announcements

- Visit nearest branch.

- Look for “Student Loan 2025” updates.

Step 2: Obtain & Fill the Application Form

- Download the form online or collect it from an Akhuwat office.

- Fill in personal, academic, and financial details accurately.

Step 3: Put Together Required Files

- Academic Records (Matric, Intermediate, University admission letter).

- Income Proof (Salary slips, employer letter, or union council certificate).

- Identity Documents (Student’s CNIC/B-Form, guardian’s CNIC).

- Residence Proof (Utility bills, rent agreement).

Step 4:Complete and Send

- Submit the form along with documents at the nearest Akhuwat branch.

- Save duplicates for your personal reference.

Step 5: Interview & Verification Process

- Shortlisted candidates will be contacted to attend an interview.

- Akhuwat may conduct a home visit for authenticity checks.

Step 6: Loan Approval & Disbursement

- Successful applicants receive an approval notification.

- Funds are directly paid to the educational institution.

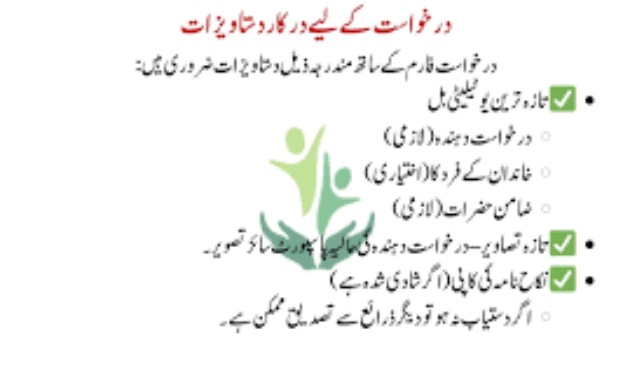

List of Required Documents for Akhuwat Loan Application

To prevent any delays, make sure you have these documents prepared in advance:

Academic Documents

- Matric & Intermediate mark sheets

- University admission letter

- Latest academic transcript (if already enrolled)

Financial & Identity Proof

- Student’s CNIC/B-Form

- Guardian’s CNIC & income certificate

- Utility bill (electricity/gas) for address verification

Supplementary Materials (If Needed)

- Orphan certificate (from NADRA or Union Council)

- Disability certificate (for special needs students)

Repayment Terms – How Does It Work?

Akhuwat’s loan model is based on trust and social responsibility. Key repayment details:

1. When Does Repayment Start?

- 6 months after graduation (grace period to secure a job).

2. Repayment Structure

- Flexible installments (based on income level).

- No fixed monthly amount—pay what you can afford.

3. How to Repay?

- Bank transfer to Akhuwat’s account.

- In-person payment at any Akhuwat branch.

- Online payment (if available).

4. Moral Commitment Over Legal Enforcement

- Unlike banks, Akhuwat does not take legal action for non-payment.

- However, graduates are morally encouraged to repay so others can benefit.

Why Should You Choose Akhuwat Over Other Loans?

✅ 100% Interest-Free – No hidden charges or compounding interest.

✅ Inclusive for All Fields – Covers medicine, engineering, arts, and vocational courses.

✅ No Credit History Required – Ideal for students with no financial background.

✅ Transparent & Fair Selection – No bribes or favoritism.

Frequently Asked Questions (FAQs)

1. Can I apply if I’m already receiving HEC or other scholarships?

No, Akhuwat does not allow students to hold multiple financial aids simultaneously.

2. Is there an age limit for applicants?

No strict limit, but preference is given to younger students.

3. What happens if I drop out of university?

You must inform Akhuwat immediately. Repayment terms may be revised.

4. Can I repay the loan before graduation?

Yes, early repayment is allowed and appreciated.

5. How long does the approval process take?

Typically 4-8 weeks, depending on verification checks.

Final Thoughts – Is Akhuwat Loan Right for You?

The Akhuwat Student Loan 2025 is more than just financial aid—it’s a movement towards equitable education in Pakistan. By removing the burden of interest and rigid repayment terms, Akhuwat empowers students to focus on their studies without financial stress.

Need Further Assistance?

- Visit: https://techzone99.com/

- Visit a Branch: Locate the nearest Akhuwat office via their website.

Don’t let finances dictate your future. Apply now and take the first step toward your academic dreams! 🎓